2022 Domestic and International Economic Forecast... South Korean Economic Growth Rate Records 2.8%

Domestic economy weakens as COVID-driven boost diminishes, export-led growth weakens

Despite ongoing variant viruses, gradual progression of 'With Corona' expected

The global economic slowdown is expected to lead the South Korean economy into a downward trend after the second half of next year.

This is due to the reduced pace of growth in global demand for durable goods and non-face-to-face IT needs, which had surged due to the COVID-19 pandemic, leading to weakened export-driven growth. Major global companies have accumulated substantial intermediate goods inventories during the crisis period,

and considering the high risk of a future economic downturn, global demand for parts and materials is likely to slow down. However, the gradual recovery of service consumption with the implementation of 'With Corona,' and the increase in new housing constructions due to price rises from supply shortages, are expected to prevent a rapid economic downturn.

The LG Economic Research Institute recently published a report containing these contents in its 2022 domestic and international economic outlook report.

According to the report, the domestic economic growth rate is expected to reach 3.9% this year and 2.8% next year. A modest recovery in traditional service demand, which has high labor intensity, is expected to continue the trend of improved employment situations, with an estimated increase of about 280,000 jobs next year. Consumer price inflation is expected to gradually slow down after peaking in the fourth quarter of this year, but it will remain high, exceeding 2%, until the first half of next year.

Despite the uncertainty caused by the emergence of variant viruses, economic activity restrictions are expected to gradually decrease, considering the expansion of vaccination and treatment distribution and increased fatigue from lockdowns.

The global economy, while fluctuating due to the spread of variant viruses, is expected to continue a gradual recovery before entering a downturn in the latter half of next year.

The report predicts that the global economic growth rate will decrease from 5.8% this year to 3.9% next year, and with the fading of the COVID base effect, it will further decline to around 3% after 2023.This year's severe supply chain bottlenecks are expected to ease gradually, but there is a high probability that the inflation rate in major countries will continue to exceed 2% next year. This is due to the possibility of production disruptions recurring due to the spread of COVID variants, and the expectation that energy prices will remain high as fossil energy investment fails to recover amidst the global trend towards decarbonization.Additionally, as global inflationary pressures intensify, the shift to monetary tightening is expected to happen earlier than initially anticipated.After the COVID crisis, the quantitative easing programs in the United States and the Eurozone are scheduled to end in March next year, with interest rate hikes in the U.S. likely to start in June. Although the shift to tightening will slow the rise in the prices of risky assets and increase volatility, considering the extent of the rise in bond yields in major countries, the overvaluation of risky assets, and the fundamentals of emerging countries, the likelihood of a crisis is not significant.In the domestic bond market, where corporate bond spreads have already narrowed close to pre-crisis levels, government and high-quality corporate bond yields are expected to rise gently, showing a trend of synchronization. With the global shift to tightening, the dollar is expected to enter a trend of strength, and the won/dollar exchange rate is projected to rise to 1,160 won in the first half and 1,170 won in the second half of the year. Despite the slowdown in exports, the stabilization of import prices, such as international oil prices, and the maintenance of a high current account balance, along with robust demand from foreign investors for domestic bonds, are expected to limit the extent of the won's depreciation.Meanwhile, the size of the domestic fashion market in 2021 was reported to have risen by 7.5% to 43 trillion and 3,508 billion won compared to the previous year. According to the Korea Federation of Textile Industries, the domestic fashion market turned to an upward trend for the first time in three years this year, attributed to increased retaliatory consumption due to COVID-19 and the performance improvement due to the diversification of online channels by fashion companies.*** TAG 0 ***#EconomicGrowthRate #EconomicForecast #GlobalEconomicOutlookRead more this category

1. Kim Do-yeon’s Understated Airport Look, Radiating Mature Elegance

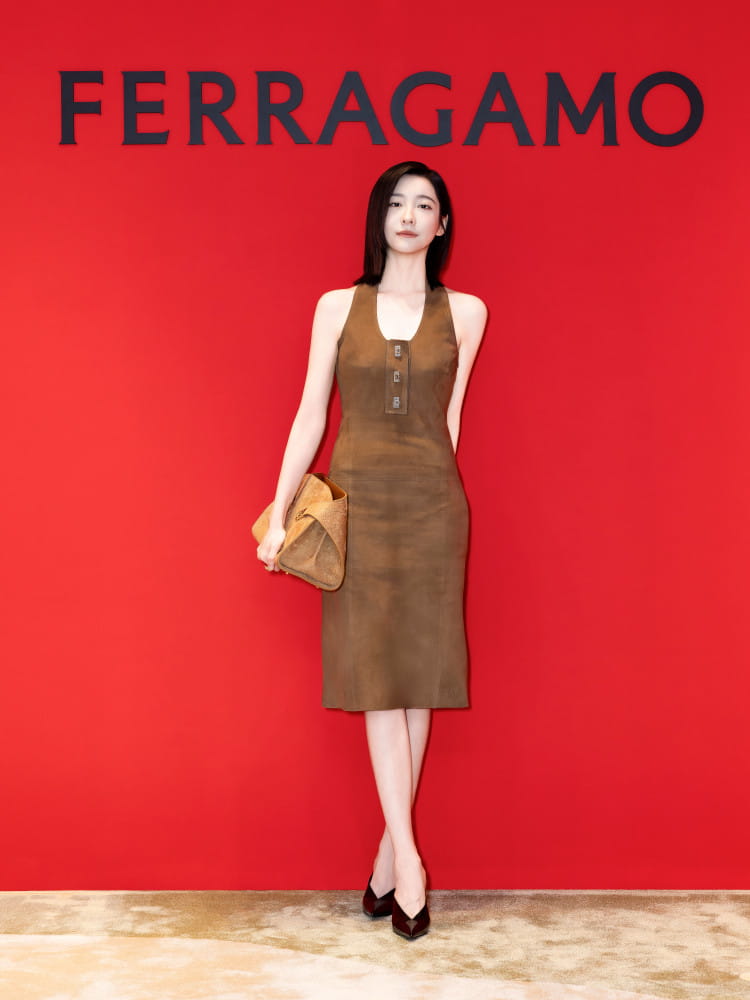

1. Kim Do-yeon’s Understated Airport Look, Radiating Mature Elegance 2. Park Ji-hyun, Lomon, and Miyao Narin Wear Ferragamo’s “Hug”

2. Park Ji-hyun, Lomon, and Miyao Narin Wear Ferragamo’s “Hug” 3. Krystal’s Fall Essentials Mood

3. Krystal’s Fall Essentials Mood 4. E.B.M Expands the “UNI Section” with NANA

4. E.B.M Expands the “UNI Section” with NANA 5. K-Fashion’s Next Leap: 2026 F/W Seoul Fashion Week Opens

5. K-Fashion’s Next Leap: 2026 F/W Seoul Fashion Week Opens 6. ENHYPEN, Prada’s New Faces Set to Captivate Taiwan

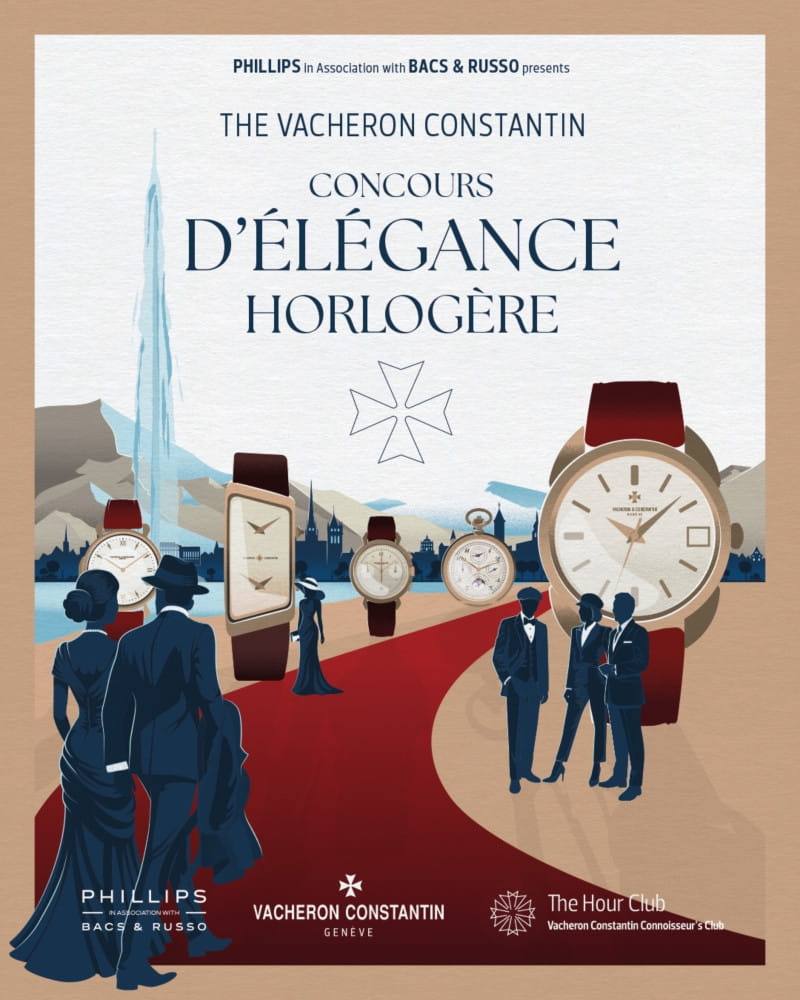

6. ENHYPEN, Prada’s New Faces Set to Captivate Taiwan 7. Vacheron Constantin x Phillips Auction Crowns the Best Rare Watches

7. Vacheron Constantin x Phillips Auction Crowns the Best Rare Watches