The Samsung Fashion Institute has announced the <2025 Top 10 Issues in the Korean Fashion Industry>.

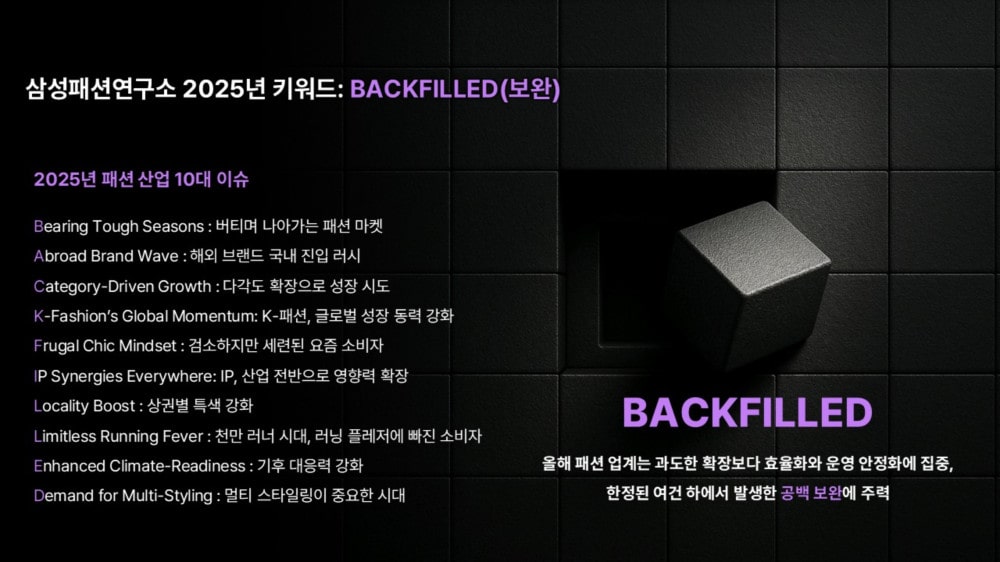

Samsung Fashion Institute, run by Samsung C&T's fashion division, has chosen this year's keyword as 'BACKFILLED' and unveiled the top 10 issues in the Korean fashion industry for 2025 on the 18th.

The Samsung Fashion Institute is a specialized research organization in the fashion industry, conducting in-depth analysis of domestic and international fashion market environments and trends data, and annually releasing materials on major issues in the Korean fashion industry and forecasts for the coming year.

Lim Ji-yeon, director of the Samsung Fashion Institute, explained the keyword of the year by stating, "In 2025, the Korean fashion industry focused more on efficiency and stable operations rather than excessive expansion, influenced by global uncertainties and a sluggish domestic environment," and evaluated this year as a time of efforts to 'backfill' gaps caused by challenging business conditions.

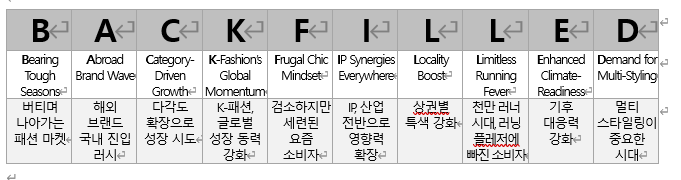

■ 2025 Keyword: BACKFILLED

■ Top 10 Issues in the Fashion Industry for 2025

- Bearing Tough Seasons: Fashion Market Perseveres

This year was another challenging one for the fashion industry. With economic recession leading to reduced consumer spending, and rising prices and unusual weather increasing price sensitivity, fashion, as a discretionary consumer good, was the first to experience a decline in consumption. According to the Samsung Fashion Institute's own survey in the second half of the year, interest in the 'fashion' sector remained stagnant, ranking lower than 'hobbies/leisure' and 'travel', and the fashion retail sales of Statistics Korea also failed to reach the level of the same period last year on a cumulative basis for the third quarter.

Amid these challenges, the fashion industry is accelerating its efforts to streamline operations by concentrating resources on core brands and discontinuing or downsizing inefficient brand businesses. The expectation of a rebound in performance due to the effects of Black Friday and increased demand for winter outerwear due to sudden cold snaps in November is a positive factor. The consumer sentiment index in November reached 112.4, the highest in eight years, and the clothing expenditure outlook index, which started at 91 at the beginning of the year, also showed an upward trend by reaching 100.

The Samsung Fashion Institute forecasts that the fashion market will grow by 2.4% this year and next. Considering the inflation rate of around 2% in November, this is not seen as a high growth rate, and fortunes are expected to vary depending on the category.

- Abroad Brand Wave: Rush of Foreign Brands Entering the Domestic Market

The status of Korea in the global fashion market is gradually shifting from being a 'regional market' that passively followed the strategies of overseas headquarters to a 'test bed' that tests and leads trends across Asia. Foreign fashion brands are competitively entering the domestic market in response to the changed status of the Korean market. Brands that have not yet established domestic recognition are entering through major fashion companies, while those with established recognition are entering the domestic market directly.

This year, Japanese brands have particularly stood out. The collaboration products of 'Uniqlo' and 'Needles' caused open run on the day of release, and 'Pleats Please Issey Miyake', which frequently sold out immediately upon arrival, opened a pop-up store in Seongsu last July, buoyed by its popularity. 'Captain Sunshine', a Tokyo-based contemporary brand that was previously showcased in select products at 'Beaker' stores, opened its first standalone store at Shinsegae Department Store in Gangnam in October, signaling the start of its domestic business. Street fashion brands 'Undercover' and 'Y-3' have also entered the domestic market. Additionally, Japanese representative fashion select shops have also entered the Korean market this year. 'Beams' opened its first pop-up store, drawing attention, and 'Studious' and 'Bshop' opened official stores.

- Category-Driven Growth: Attempt to Grow through Diversified Expansion

As the fashion business environment becomes challenging, efforts for growth through diversified category expansion are being developed across the board. Through this, they are seeking long-term growth by not only expanding short-term sales but also broadening customer contact points and strengthening business stability.

Fashion brands that were primarily focused on clothing are actively expanding into accessory categories such as bags, shoes, ball caps, and eyewear. Additionally, there are more attempts than ever to expand the customer base beyond core targets, such as launching women's lines for menswear brands, entering menswear for women's brands, and launching new brands targeting young consumers. The contemporary brand 'Recto', which started with womenswear, launched a casual brand 'Ridge' targeting young consumers after establishing its menswear line, and Fivespace, the company behind 'ADER Error', introduced a new womenswear brand 'Take Tuktaken'.

There has also been an increase in the launch of beauty lines that capture the unique mood of fashion brands. 'Musinsa Standard' introduced an ultra-affordable skincare line, and 'Covernat' launched 'Covernat Beauty', focusing on lip and fragrance products.

- K-Fashion’s Global Momentum: Strengthening the Global Growth Engine of K-Fashion

With the combination of sluggish domestic demand and expanding demand for K-Fashion in the global market, the domestic fashion industry is accelerating its business expansion with overseas markets as a key growth momentum. Major fashion companies are expanding their reach to China, Southeast Asia, and Europe, focusing on their main brands. '8seconds' of Samsung C&T's fashion division opened its first store at SM Mall of Asia in Manila, Philippines, in July and expanded to its third store. 'Juun.J' opened a standalone store in a Shanghai department store last year, increasing its recognition in the local market, and 'System' of Handsome conducted its first fashion show in Thailand this year, marking the start of its expansion into Southeast Asia.

Emerging casual brands that have ventured overseas early are expanding their influence in already entered countries while rapidly diversifying their entry regions. 'Matin Kim' entered Amazon in the US and Eastern European select shops beyond Asia, and 'Mardi Mercredi' also entered Amazon in the US and converted its Greater China business to direct management. 'Amomento' opened a flagship store in Tokyo and established a Chinese corporation.

Large retailer platforms that assist K-Fashion brands in entering overseas markets are also accelerating business expansion. Shinsegae Department Store's 'Hyperground' sequentially opened pop-up stores in Japan and Singapore this year, and Hyundai Department Store's 'The Hyundai Global' opened its first regular store in Tokyo last September.

- Frugal Chic Mindset: Today's Consumers Who Are Thrifty Yet Stylish

As the era of high prices continues, last year's consumption pattern focused on thriftiness has become more sophisticated, evolving into maintaining one's own stylish taste even within restrained consumption. These consumers are characterized by combining practicality and aesthetics, carefully comparing, and choosing items with caution, while finding their own reasons for purchase.

When purchasing essential items like basic T-shirts or innerwear, they are particularly mindful of physical and price accessibility, which is closely related to the 'price decoding' behavior, where they analyze price tags, distribution margins, and brand value to pursue their own super-rationality. The rapid sales of ultra-affordable clothing at 'Daiso' or the entry of fashion brands into convenience store 'GS25' can be understood in this context.

There is also a growing interest in the vintage market. The perception has shifted from buying someone else's clothes cheaply to embarking on a journey to find unique items. In response, some fashion companies and department stores have introduced services to trade second-hand fashion products.

- IP Synergies Everywhere: Expanding Influence of IP Across Industries

This year was also marked by the market impact of character IPs. Particularly noteworthy is the stronger and simultaneous spread of major IPs, fueled by global popularity. While traditional IPs like Kakao Friends, Sanrio, and Miffy have maintained their popularity, emerging IPs like Pop Mart's 'Labubu', Sega Toys' 'Monchhichi', and Netflix's 'K-Pop Demon Hunters' have explosively grown, establishing themselves as new mega-trends.

These character IPs have expanded beyond the consumption of goods centered on dolls and keyrings to become a cultural trend encompassing brand, distribution, content, and entertainment across industries. Notably, 'Labubu' gained global popularity, leading to a shortage phenomenon, as demand surged following exposure on global celebrities' social media. 'Labubu' has engaged in collaborations across industries, including fashion brands, and is preparing to expand into film and animation content businesses. Netflix's globally successful 'K-Pop Demon Hunters' also launched collaborative products with various industries, including '8seconds', 'GS25', and 'Nongshim', and even established a theme zone within 'Everland'.

- Locality Boost: Strengthening Characteristics by Commercial District

Major shopping districts are becoming more distinct with their unique identities, leading to differentiated consumer experiences expected in each district. Consequently, the types of brands concentrated in each district are becoming clearer, making it increasingly important to select optimized locations that match brand characteristics when developing store entry strategies.

Seongsu-dong has evolved from the 'holy land of pop-ups' to a hub for K-Fashion and K-Beauty, with large signature spaces of K-Eyewear brands like 'Gentle Monster Hausnowhere Seoul' and 'Blue Elephant Space Seongsu' appearing one after another, enhancing Seongsu's unique sightseeing and experience-focused consumer culture. Hannam, centered around the existing 'Comme des Garçons Street', has become a fashion district focused on sensibility, with flagship stores of emerging womenswear brands like 'Mango Many Please', 'Ohessio', and global brand 'Alo' concentrated this year. Hongdae has emerged as a district for online-based emerging brands to debut offline, with stores of brands like 'aeae' and 'Coiseio' that cater to young consumers opening actively, while the area near Dosan Park has become a mecca for streetwear brands with stores of 'Stussy' and 'Human Made' opening consecutively this year.

With an increase in foreign tourists, areas where traditional charm can be felt are emerging as new K-Fashion districts. In the Bukchon and Samcheong areas, 'The Ilma' and 'Monoha' opened stores, and 'Matin Kim' and 'Marithe Francois Girbaud' have newly entered Gwangjang Market, transforming the traditional market image and expanding it into a new fashion district that encompasses both tradition and modernity.

- Limitless Running Fever: The Era of 10 Million Runners, Consumers Enchanted by Running Pleasure

This year could be called the 'year of running', as running has emerged as a new lifestyle beyond just an activity enjoyed by some consumers, gaining socio-economic significance to the point where the concept of 'runconomy' has appeared.

In the midst of economic recession, the distribution and fashion industries are focusing on the running industry as a new driving force, actively responding to the rapidly increasing consumer demand. With increased running-related sales, the top three department stores are placing running-related stores in key locations and enhancing running content. The globally popular brand 'On Running' made its direct entry into the domestic market and opened its first store this year. In addition to traditional sports brands, athleisure, outdoor brands, and fashion brands are expanding their running-related product lines or launching new lines in response to the running boom. Fashion select shops are also strengthening their running categories. Samsung C&T's fashion division's '10 Corso Como Seoul' newly imported 'Alex Jonno' and 'Satisfy', and 'Beaker' expanded its running category with 'Una'.

- Enhanced Climate-Readiness: Strengthening Climate Resilience

Climate change has become a constant rather than a variable. With abnormal weather becoming the norm and increasing consumer demand for lightweight, cool clothing and preparedness for unpredictable weather, summer, once considered an off-season, is emerging as an important season.

Cooling materials, which were primarily functional elements for specific activities in sports and outdoor categories, have now expanded into everyday clothing regardless of category or item. Additionally, items like parasols, rain boots, and sunglasses have become everyday essentials. 'Gentle Monster' and 'Blue Elephant', known for their stylish eyewear, are rapidly growing, and Samsung C&T's fashion division's 'Beanpole Accessory' expanded its 'Anyweather' line to include ponchos and bags, in addition to rain boots and parasols.

The convergence of sudden weather changes and a focus on versatility has led to increased demand for practical lightweight down jackets instead of traditional fall outerwear. According to Samsung C&T's fashion division's online platform 'SSF Shop', searches for the keyword 'lightweight down jacket' increased by 46% from November 1 to December 9 compared to the same period last year.

- Demand for Multi-Styling: An Era Where Multi-Styling Matters

As consumers who maintain their own style while pursuing rationality focus on multi-styling that allows them to use a single item in various ways, the fashion industry is launching multi-way items. Recently, with minimal trends like quiet luxury and demure continuing, reversible and layering styles that offer slight variations in style are particularly popular.

'Angae' of Samsung C&T's fashion division, which allows experiencing various moods with a single item through layering, is gaining attention recently, and Shinsegae International launched the brand 'Ja' this year, which is based on the concept of mix-fit that can respond to various TPOs of consumers.

From a color perspective, brown, which can be used in various stylings from polished office looks to comfortable casual, is notably popular. Brown, along with beige and gray, is easy to style in tone-on-tone fashion or matched with point colors like blue and red, allowing a single item to create various impressions, thus gaining popularity.

```Read more this category

1. "Spotlight on 2026's Quarter-Zip Fashion"

1. "Spotlight on 2026's Quarter-Zip Fashion" 2. Samsung Fashion Institute Unveils Top 10 Fashion Trends for 2025

2. Samsung Fashion Institute Unveils Top 10 Fashion Trends for 2025 3. ‘CASETiFY X Won Soju’ Limited Edition Collection Release

3. ‘CASETiFY X Won Soju’ Limited Edition Collection Release 4. Rimowa launches the 'RE-CRAFTED' program for sustainability

4. Rimowa launches the 'RE-CRAFTED' program for sustainability 5. Max Mara X Roblox, 'Max Mara Coats Adventure' Unveiled

5. Max Mara X Roblox, 'Max Mara Coats Adventure' Unveiled 6. Gift love in a limited edition

6. Gift love in a limited edition 7. TUMI, Selected as Official Luggage for PGA-LPGA Tour

7. TUMI, Selected as Official Luggage for PGA-LPGA Tour