According to the "Korean Fashion Consumer Market Big Data 2023" yearbook organized by market research agency Trend Research (http://www.trendresearch.co.kr/), the size of the Korean fashion market in 2022 is calculated to be 47 trillion and 910 billion won, an 8.2% increase from the previous year. This is the largest size ever and more than double the 21 trillion won size in 2000, about 20 years ago. Meanwhile, the market size for 2023 and 2024 is projected to be 49.5 trillion won and 51.3 trillion won, respectively, forecasting growths of 5.2% and 3.5%.

This data has been announced by Trend Research based on the consumption trend index, corporate performance index, and industry trend index built from the Big Data research of the Korean fashion consumption market over the past 25 years since 1998.

The size of the Korean fashion market was calculated by applying the number of the population to the consumption trend index, which includes the rate, volume, and price of fashion products purchased by our citizens over the past six months (first half from March to August, second half from September to the following February).

The historic high performance of 2022 was based on the high resilience of our fashion market, which increased speed and agility, essential elements to quickly adapt to economic and social changes and maintain competitiveness.

The fashion loungewear market for consumers who experienced comfort at home and in activities during the COVID-19 era, the casual style market where the boundaries between sportswear and everyday wear have blurred, and the multi-item small quantity MD market based on personalized consumption and preferences, as well as the discovery of fashion culture brands in various cultural spaces like the Seongsu area, have also accelerated growth in the new consumer market.

All eight segmented markets recorded their highest-ever performance, with the casual wear market entering the 18 trillion won era with a 6.1% increase to 18.4711 trillion won compared to the previous year, and the footwear and sportswear markets recording 7.1625 trillion won and 6.5007 trillion won, respectively, with increases of 7.4% and 12.3%. The proportion of these three leading markets in the fashion market increased by 0.6%p to 69.2% compared to the previous year. Men's suits (growth rate 8.4%, market size 4.826 trillion won), bags (18.7%, 3.4865 trillion won), women's suits (0.9%, 3.1125 trillion won), underwear (13.2%, 2.3387 trillion won), and children's clothing (6.1%, 1.1930 trillion won) followed.

Sales of 270 fashion companies engaged in fashion manufacturing and specialized distribution in 2022 also increased by 16.2% to 46.9807 trillion won compared to the previous year, and operating profits increased by 54.7%, with the average operating profit margin rising to 10.3%. The performance of fashion companies, which had been depressed due to the COVID-19 pandemic, recovered rapidly.

Meanwhile, the performance improvement of global luxury and foreign companies was more noticeable than that of Korean domestic companies. Analysis of the growth power of fashion companies showed that the growth power of global luxury companies, including Louis Vuitton Korea, Christian Dior Couture Korea, Chanel Korea, Nike Korea, Ralph Lauren Korea, Prada Korea, and Hermès Korea, was stronger than that of Korean companies.

Among Korean companies, Musinsa and The Nature Holdings were evaluated as top groups with high future market positions, and Hansom and Shinsegae International (Group) were also ranked in the top group for growth power. On the other hand, domestic conglomerates such as Samsung C&T (Fashion Business), LF (Group), E-Land World, and Kolon Industries (Fashion Business) were evaluated as having stagnant business growth compared to foreign companies, while Kumkang Group, Hanse (Domestic Group), Sejung (Group), and Hyeongji (Fashion Group) were evaluated as companies with declining growth.

For the analysis of corporate growth power, the BCG Matrix method of the Boston Consulting Group was applied to analyze the matrix based on the market share (X-axis) and the average annual growth rate over five years (Y-axis) of the companies in the respective year.

The Korean fashion market is expected to continue its positive growth for the third consecutive year in 2023, with the casual wear, footwear, sportswear, and women's suit markets leading the growth.

Looking at the Consumer Sentiment Index (CSI) of fashion consumers for the first half of 2023, it showed signs of improvement for four consecutive periods. The current living standard level and the level of fashion product purchases were 49.7p and 48.9p, respectively, up 0.5p and 0.9p from the previous period. However, the fashion product purchase outlook index rose only 0.2p to 53.1p compared to the previous period.

The Fashion Business Sensitivity Index is composed of three items: the current living standard level (whether our household's living standard has improved compared to a year ago), the level of fashion product purchases (whether more clothes were purchased compared to a year ago), and the fashion product purchase outlook (whether more clothes will be purchased over the next year), and the results answered on a 5-point scale at the time of the survey are calculated out of a perfect score of 100, with values above 50 indicating positive sentiment and values below 50 indicating negative sentiment.

The casual wear market is expected to achieve a comfortable target of 19.5591 trillion won, a 5.9% increase from the previous year, with the fashion casual market flaunting street sensibilities becoming a new growth engine, and absorbing outer customers who prefer sports sensibilities.

The sportswear market, which turned to positive growth for the first time in three years, is expected to continue its positive growth for the second consecutive year due to the recovery of everyday life and the increase in outdoor activities, aiming to reclaim the 6.7566 trillion won range, a 3.9% increase.

The footwear market is expected to surpass 7.5948 trillion won in 2023, a 6.0% increase following the 7.4% growth of the previous year, with the increase in consumption by the MZ generation centered around luxury leather sneakers and fashion sneakers released by sports specialty companies.

Meanwhile, the bag market is expected to grow 4.4% to 3.6415 trillion won, following last year's high growth of 18.7%. While luxury consumption will continue to grow, the market is expected to maintain a low growth base in the future without new momentum to stimulate the market.

In 2024, the growth of the Korean fashion market is expected to slow down due to geopolitical risks such as high interest rates, high inflation, and war, but it is still projected to achieve positive growth for the fourth consecutive year.

According to the OECD and the Bank of Korea, the global economic growth rate in 2024 is projected to be 2.8%, slightly higher than the 2.7% of the previous year, and the Korean economic growth rate is also expected to improve to 2.2% from the projected 1.4% in 2023, but will remain in a low growth phase. Considering these domestic and international economic variables, the Korean fashion market is expected to achieve a modest 3.5% positive growth in 2024.

Trend Research has published the "Korean Fashion Consumer Market Big Data 2023" yearbook, which includes the size of the Korean fashion market in 2022 and the forecast for 2023, and has started online paid distribution.

Read more this category

1. SO HOT... The 'rokh X H&M' Collection Launch Celebration Event

1. SO HOT... The 'rokh X H&M' Collection Launch Celebration Event 2. LMC, ‘LMC. SOCCER TEE’ Capsule Collection Unveiled

2. LMC, ‘LMC. SOCCER TEE’ Capsule Collection Unveiled 3. FaW Tokyo 2024 Spring - A 360° Focus on the Fashion Industry

3. FaW Tokyo 2024 Spring - A 360° Focus on the Fashion Industry 4. Asia's Largest Fashion Culture Market 'Fashion KODE 24 F/W' Opens

4. Asia's Largest Fashion Culture Market 'Fashion KODE 24 F/W' Opens 5. Chanel X BIFF Asian Film Academy Participants Recruitment

5. Chanel X BIFF Asian Film Academy Participants Recruitment 6. Wards Corporation, 'Honda' Sign Master License Agreement

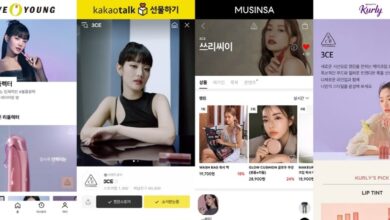

6. Wards Corporation, 'Honda' Sign Master License Agreement 7. 3CE, Aiming Precisely at Female Customers in Their 20s and 30s with Diversified Distribution Channel Strategy

7. 3CE, Aiming Precisely at Female Customers in Their 20s and 30s with Diversified Distribution Channel Strategy